Building Skills Using Innovative Technology

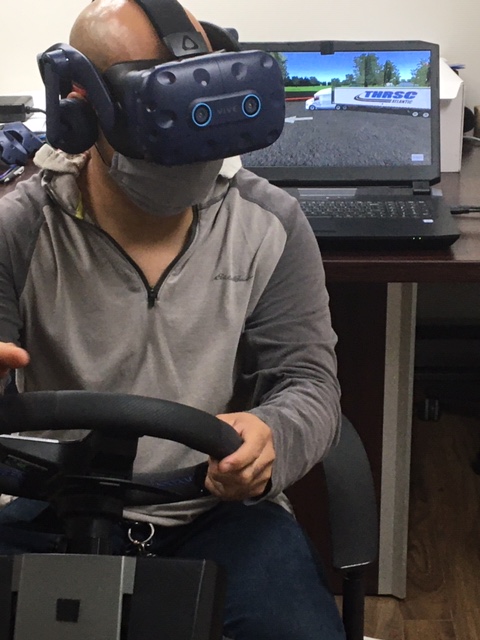

Trucking in CanadaThis project will remove the barriers to employment by providing the existing workforce skills enhancement through a Virtual Reality Simulator. The VR simulator is the first of its kind specifically for the trucking industry.

Transportation is comprised of four sectors – road, air, rail and sea. The Transportation in Canada 2017 report (link to report provided in Annex A Report Resources) recognizes that trucking is the primary method for freight transportation. It is also noted that the volume of air cargo and truck activity to and from the US increased in 2017.

Economically transportation for Canada grew in 2017 by 4.8% (close to 1.5% the growth rate for all industries) and represented 4.6% of the total GDP. And the compound annual growth for the previous five years was 3.3% exceeding that of the economy as a whole.

Commercial transportation represents 5% of the total employment in Canada. Road Transportation represents close to 50% of employment with over 400,000 in the Canadian trucking industry of the 905,000 in Transportation and Warehousing combined. Transportation demands increased in 2017 and it is anticipated they will continue to grow in the coming years between 2% – 3% over the next couple years.

Transportation in Canada represents:

4.6 %

of the total GDP

5 %

of total employment

400,000

over 400,000 road transportation employees

905,000

with over 905,000 in transportation and warehousing combined

The federal government has indicated their key priorities moving forward will be autonomous vehicles and preparing provinces and the sector for that change. They have also identified reducing vehicle emissions for transportation to zero.

Trucking is a multi-billion dollar industry across Canada and is comprised of small, medium and large size companies representing for-hire, courier / delivery / owner operators and private fleets. Trucks continue to be the main mode of transportation to other modes of transportation including air, rail and marine.

With more than 1 billion km of roads, trucking is Canada’s most important mode for freight transportation and therefore critical to domestic and international trade activities.

The labour challenge, as reported for the past 10 years, is the professional driver shortage and qualified professional drivers with the skills required of professional drivers in today’s changing workplace. With changing or enhanced regulations around transportation of dangerous goods, electronic logging devices, autonomous trucks on the horizon and truck emissions – many professional drivers in the trucking today are concerned about continued opportunities and whether they have the skills to meet the growing demands.

45

national average age for professional drivers

53 - 55

average age of professional drivers in Nova Scotia

24,000

national professional driver shortage

100 - 120

new entrants annually

With the Canadian national average age for professional drivers at 45 years of age, the average age of professional drivers in Nova Scotia are in the range of 53 – 55 years of age. Some companies are stating their fleet average age for drivers (note this is based on a fleet in excess of 1500 employees) is 56 years of age. Based on the aging demographic, it is easy to appreciate the potential intimidation of the workforce to need more support and skills enhancement to safely and productively remain in the sector.

The professional driver shortage nationally is referenced to be 24,000 by the year 2020. This is a need of new entrants or those who may return to the sector and does not allow for retirements. With the training providers in Nova Scotia, for example, graduating on average and collectively, 100 – 120 new entrants annually we do not have enough people coming into the sector – we cannot ignore the existing workforce. Industry is prepared and willing to identify what they can do to be a catalyst in increasing those numbers to build toward bridging that gap while ensuring all training providers meet or exceed minimum industry training requirements.

Growth of the Sector

Nationally we noted above freight transportation will grow between 2% – 3% in the next 2 – 3 years; this is consistent with the American Trucking Association report that freight transportation will increase similarly. Given the trade between the US and Canada, this is logical and validates the ongoing for demand.

Project Description

Given the existing driver shortage that is well publicized and the efforts to reduce the loss of the existing workforce this project will focus on enhancing the skills of the existing workforce to better support their efforts in having the skills to adjust to the ongoing and changing technology.

We know that lower essential skills among professional drivers are linked to increased accidents and incidents. We also know in these circumstances the professional drivers can cost a company more money than those with higher essential skills. We also know quality skills professional development and preparation for both the existing workforce as well as those entering the workforce requires more support than many currently receive.

From there we will work with companies to gather driver data to establish baselines. After the interventions, the drivers will continue with their work and we will reassess during the project timeframe to measure successes, advancements and increased productivity among the workforce.

We will also develop a return on investment so that during the final consultation phases employers will understand how using current technology for ongoing training will support the existing workforce. It is strongly believed these efforts will support the retention of the existing workforce; thereby, supporting the efforts to retain the existing workforce.

These findings will also support the recruitment of new people to the sector with innovative teaching tools being introduced to support varied learning styles.